AI Transforming Mortgage Industry - Automation of Document Processing

A decade ago the volume-heavy, error-prone and sluggish business processes of mortgage companies that take up considerable human labor were still struggling to find a direction with the technological transformation. Automation has finally kicked in for the Industry. Not only have the mortgage companies become more efficient, but the decision making logic has also evolved with the application of robotics and AI. The focus is now fixated on automating tasks, minimizing errors & improving customer experience.

With the introduction of AI technologies like machine learning, mortgage professionals have been meeting their targets while achieving better customer satisfaction. Most of the work which was reliant on manpower is now being done by computers. As a result, professionals can shift their attention to more strategic aspects of the job like managing problems and processing exceptions. Infrrd’s AI-led automaton is enabling mortgage companies to replicate human reasoning via machine learning, predictive modeling and NLP.

Few of the processes that Infrrd has been automating for mortgage companies are:

With the introduction of AI technologies like machine learning, mortgage professionals have been meeting their targets while achieving better customer satisfaction. Most of the work which was reliant on manpower is now being done by computers. As a result, professionals can shift their attention to more strategic aspects of the job like managing problems and processing exceptions. Infrrd’s AI-led automaton is enabling mortgage companies to replicate human reasoning via machine learning, predictive modeling and NLP.

Few of the processes that Infrrd has been automating for mortgage companies are:

- Application Processing

- Contract processing

- Invoice/Receipt processing

- Claims Processing

- Loan Origination, Servicing & Recovery

- Underwriting

- Credit reports

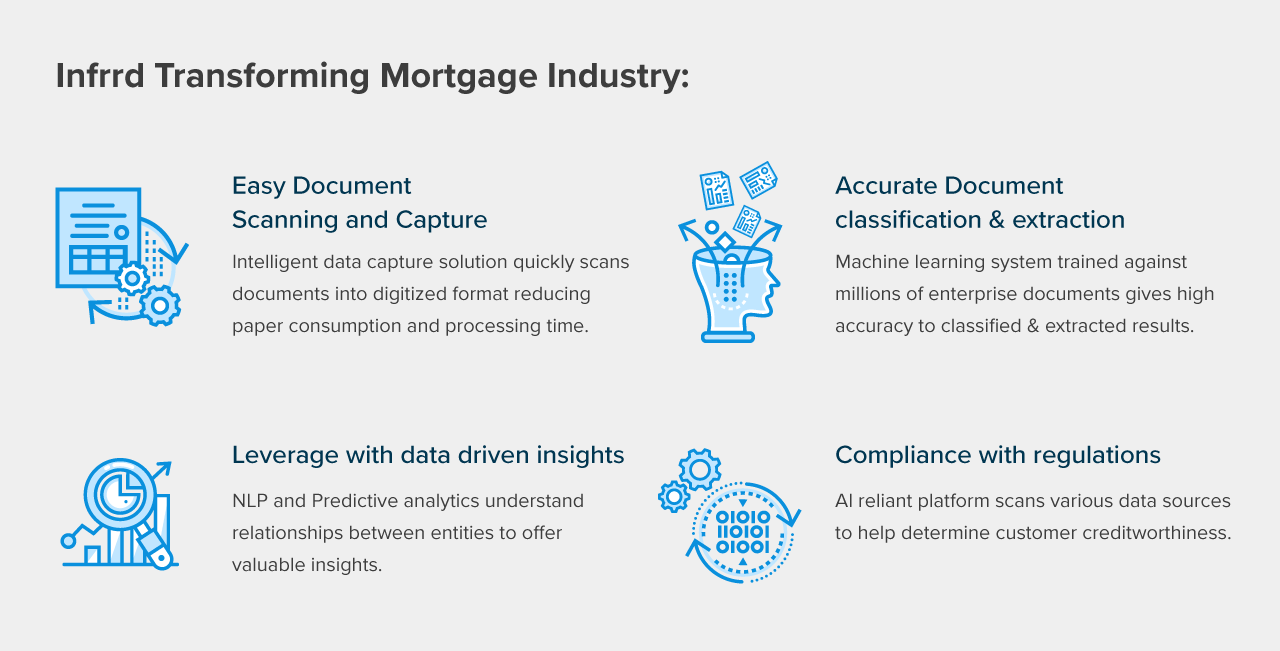

1. Easy Document Scanning and Capture

Assessing large creditworthy documents is often a tedious task. With our intelligent data capture solution, mortgage-related documents can be scanned into digitized format reducing paper consumption as well as overall processing time. Be it applications, credit reports, employment verification forms or legal files, all of them can be quickly scanned via Infrrd’s web or mobile applications.

2. Accurate Document classification & extraction

The paper-intensive consumer lending mortgage processes get laden with many variants of documents. Going through all of them for individual clients is labor-intensive and will take a lot of hours. Our deep learning-based IDC platform classifies, identifies, separates, and organizes these lengthy documents in one go. Our machine learning system is trained against millions of enterprise documents giving a high accuracy to the extracted results. It’s not a template reliant solution, which makes it different from the ones available in the market today. Machine learning allows the software to continuously learn from any manual validation to improve system accuracy as well as reduce time spent on manual correction over time.

3. Leverage with data-driven insights

Data extraction isn’t the end of our solution. We go a step ahead to do much more than that. Our NLP and Predictive analytics algorithms understand relationships between entities, learns from the historical data and offers valuable insights in the form of financial reports or customer engagement that aid business decisions. We can predict trends and help address issues which are likely to affect the business. With this kind of insight, mortgage professionals will be able to offer their customers better service and customized products.

4. Compliance with regulations

Even with the right customer information, the complex task of determining creditworthiness might pose a grave challenge. Our AI reliant platform helps scan various data sources to offer companies the entire digital footprint of their potential borrowers, hence allowing adherence to regulations.

Assessing large creditworthy documents is often a tedious task. With our intelligent data capture solution, mortgage-related documents can be scanned into digitized format reducing paper consumption as well as overall processing time. Be it applications, credit reports, employment verification forms or legal files, all of them can be quickly scanned via Infrrd’s web or mobile applications.

2. Accurate Document classification & extraction

The paper-intensive consumer lending mortgage processes get laden with many variants of documents. Going through all of them for individual clients is labor-intensive and will take a lot of hours. Our deep learning-based IDC platform classifies, identifies, separates, and organizes these lengthy documents in one go. Our machine learning system is trained against millions of enterprise documents giving a high accuracy to the extracted results. It’s not a template reliant solution, which makes it different from the ones available in the market today. Machine learning allows the software to continuously learn from any manual validation to improve system accuracy as well as reduce time spent on manual correction over time.

3. Leverage with data-driven insights

Data extraction isn’t the end of our solution. We go a step ahead to do much more than that. Our NLP and Predictive analytics algorithms understand relationships between entities, learns from the historical data and offers valuable insights in the form of financial reports or customer engagement that aid business decisions. We can predict trends and help address issues which are likely to affect the business. With this kind of insight, mortgage professionals will be able to offer their customers better service and customized products.

4. Compliance with regulations

Even with the right customer information, the complex task of determining creditworthiness might pose a grave challenge. Our AI reliant platform helps scan various data sources to offer companies the entire digital footprint of their potential borrowers, hence allowing adherence to regulations.

At the end of the day, our technology will make tasks streamlined and help businesses expand their horizons. Adopting and adapting to it will definitely give your company an edge in this cut-throat industry where mortgage lenders are fighting commodification. We are helping mortgage companies differentiate with our AI and ML solutions and create a seamless customer experience.

Comments

Post a Comment